Many women-led startups in Singapore share a familiar arc: validate locally, then expand across ASEAN. The challenge is converting a strong home-market signal into repeatable growth. The most successful founders treat internationalization as product work, not merely sales. They rebuild pricing for local willingness-to-pay, rework onboarding flows to handle language and regulatory nuances, and hire country managers with deep networks rather than just resumes.

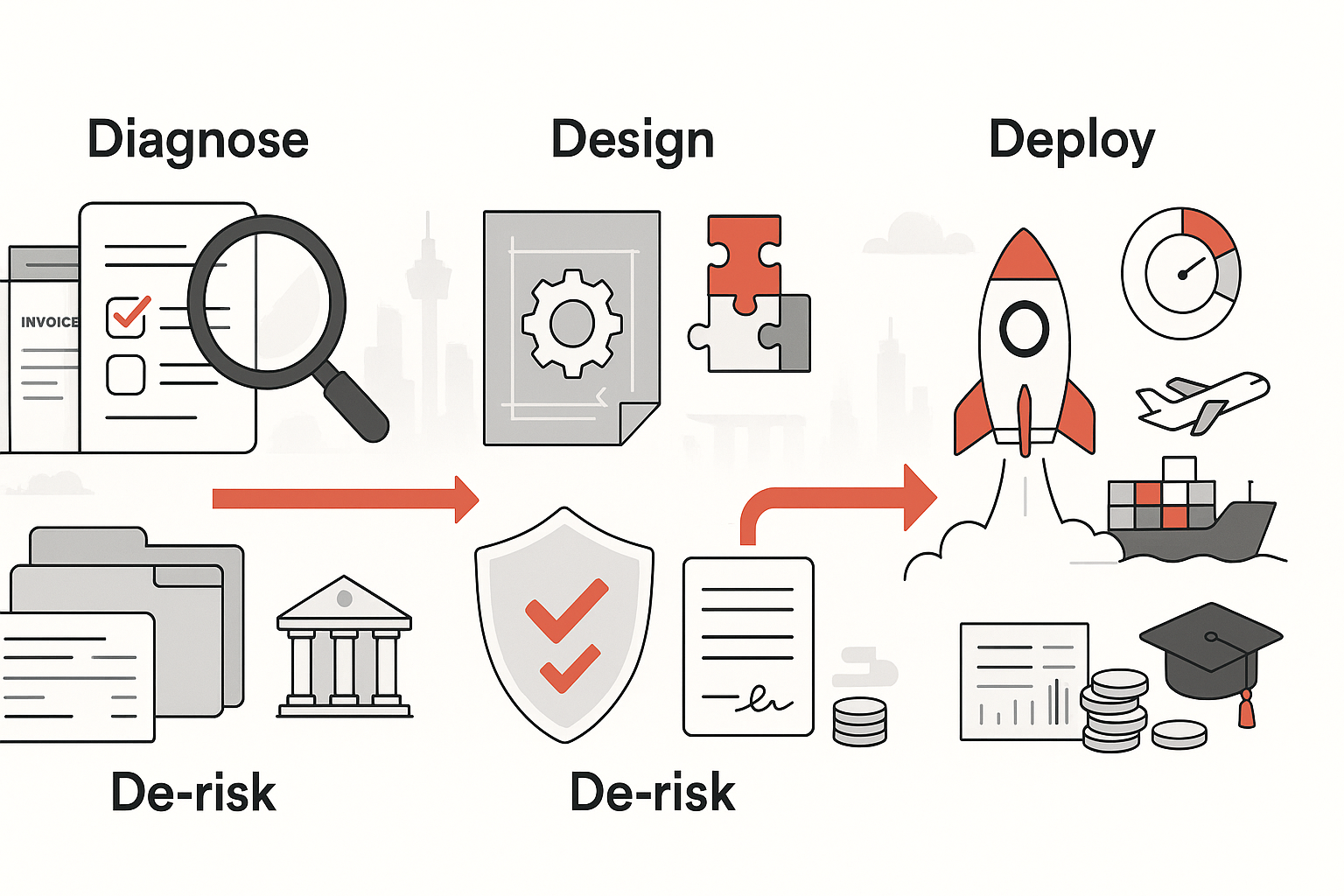

Due diligence begins with segmentation. Which customer personas exist in multiple markets with similar pain points? Where are the regulatory cliffs? Mapping distribution channels—resellers, marketplaces, corporate partners—helps estimate CAC and cash cycles before committing headcount. Women founders who maintain a disciplined dashboard across markets (pipeline velocity, win rates by segment, localized churn) can rapidly reallocate resources when signals shift.

Partnerships are the accelerant. Singapore’s credibility helps secure regional pilots with multinationals, but local champions close deals. Co-selling agreements, revenue-share arrangements, or embedded integrations shorten time to trust. For regulated sectors, aligning with local compliance advisors or legal clinics prevents costly missteps. In consumer sectors, collaborations with local creators and communities build cultural resonance faster than large ad budgets.

Culture fit within the team matters as much as market fit. Founders who articulate a clear operating system—decision rights, communication norms, documentation standards—scale more smoothly across time zones. Hiring for values and autonomy reduces managerial overhead. Many women leaders in Singapore run “guardrails, not gates”: lightweight approvals, strong metrics, and post-mortems instead of preemptive bottlenecks. This creates speed without chaos.

Capital planning changes in the scale phase. Payment terms stretch, currency risk appears, and working capital needs increase. Blending equity with venture debt, export financing, or revenue-based instruments can extend runway without excessive dilution. Founders should anticipate compliance costs—data residency, tax registration, labor laws—and bake them into country-by-country unit economics. Scenario planning across optimistic, base, and downside cases keeps expansion reversible.

The leadership journey evolves, too. Early-stage founders do everything; scale requires coaching managers, setting narrative, and choosing what to stop doing. Women entrepreneurs frequently become visible role models across the region, attracting talent who want to work where inclusion is real, not performative. That visibility is not just symbolic—it converts to lower hiring costs, stronger partnerships, and better investor confidence.

Ultimately, Singapore offers something rare: a compact testbed with global standards and regional reach. Women who leverage this—combining rigorous metrics, inclusive teams, and culturally intelligent expansion—can build companies that travel. The playbook is pragmatic: validate deeply at home, partner smartly abroad, finance expansion with a balanced stack, and lead with clarity. The opportunity is not only to grow revenue, but to imprint a more equitable template for how high-growth companies in Asia are imagined and led.