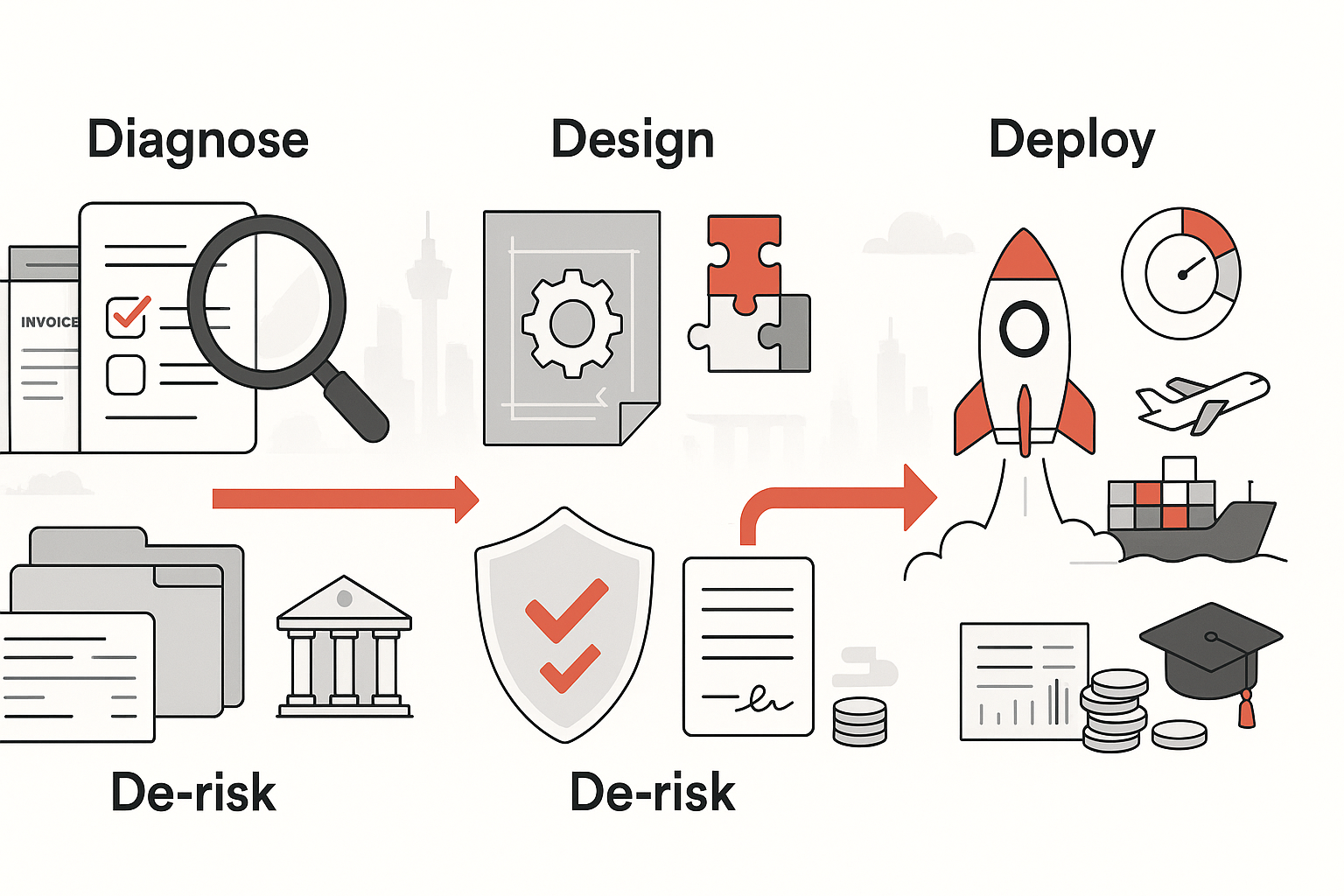

Treat the Singapore government’s MSME schemes as a playbook you can run repeatedly: diagnose, design, de‑risk, and deploy. This article focuses on execution—what documentation to prepare, how to avoid common pitfalls, and how to combine grants and bank capital without tripping over the rules.

Step 1: Diagnose. List your top three constraints (e.g., manual invoicing, inventory inaccuracies, slow sales cycles, weak export pipeline). Quantify the pain in hours, error rates, or dollars. This becomes the backbone of your problem statement and KPIs.

Step 2: Design. Map initiatives to constraints. Use PSG for commodity software and equipment. Use EDG for bespoke transformation—process redesign, automation, data infrastructure, branding, or market entry strategies. If you intend to test a neighbouring country, line up MRA for eligible marketing and business development costs. Decide which parts need bank financing under EFS—working capital, trade, fixed assets, or project funding.

Step 3: De‑risk. Shortlist vendors (for PSG, pick from the pre‑approved list). Obtain comparable quotes, define milestones, and pre‑agree measurement: what will change, by how much, by when. Check eligibility: Singapore‑registered, local shareholding thresholds, SME size definitions, project start dates (usually post‑approval). Ensure you’re not double‑claiming costs across schemes. For loans, prepare financial statements, projections, bank statements, and collateral details.

Step 4: Deploy. Submit via GoBusiness/GovAssist or bank channels. Keep procurement files, timesheets, progress reports, and invoices organised—audits and verifications are part of the process. Assign an internal project owner and hold monthly reviews against KPIs (e.g., processing time, unit cost, gross margin, export leads). If a pilot underperforms, iterate quickly; small course corrections are easier to justify than wholesale resets.

What not to do: don’t apply after you’ve already signed a vendor contract; don’t scope projects so broadly that success can’t be measured; don’t treat grants as free money detached from strategy. Banks and agencies look for credible management commitment and benefits that persist beyond the funding window.

Smart combinations: pair PSG accounting + inventory with EDG process redesign to unlock end‑to‑end visibility; use MRA to validate a single overseas market before scaling to a second; stack EFS working capital with trade financing to improve cash conversion as exports grow. Layer SkillsFuture training so staff can actually operate the new systems.

Final pointers: parameters (support levels, caps, eligible cost items) can change with Budget cycles. Verify current details with EnterpriseSG, IMDA, SkillsFuture, and your relationship bank before committing spend. When used as part of a focused roadmap, Singapore’s MSME policies and funding programmes can materially de‑risk growth and help you build a more resilient, competitive business.